Newsletter #20 (3/3/2025)

Trouble ahead for the US economy, Buffett has too much cash, Texas says education is an emergency item for this year's legislative session

Is there trouble ahead for the US economy?

The Atlanta Fed made news last week when it released its latest GDP forecast for Q1 2025.

Atlanta Fed’s GDPNow forecasting model “provides a "nowcast" of the official GDP estimate by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.” It is a “running estimate of real GDP growth based on available economic data for the current measured quarter.”

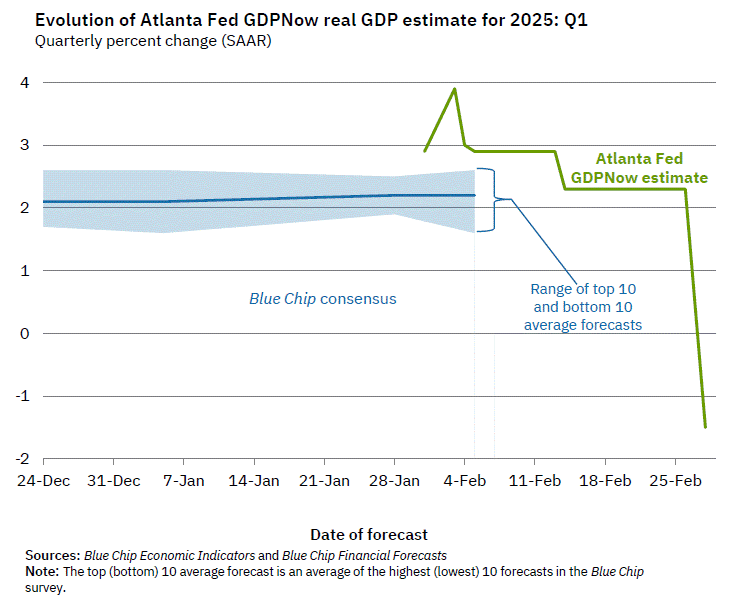

The GDPNow model estimate for real GDP in the first quarter of 2025 is -1.5 percent on February 28, down from 2.3 percent on February 19. Read that again. Slowly. Maybe a picture will help.

While it is worth noting that the Dallas Fed is still showing a 13-week moving estimate average of 2.41 percent growth in GDP, and the New York Fed is forecasting 2.9% for Q1 2025 GDP growth, this projection from the Atlanta Fed certainly catches your attention.

I’m not sure of the difference between the 3 segments of the Fed, but suffice to say the Atlanta Fed seems to be factoring in the turmoil surround tariffs and widespread layoffs occurring within the US federal government.

When you consider the amount of debt being held by Americans having now reached an all-time high, it becomes another data point to consider whether we are teetering on the brink of something more than just corporate belt tightening. According to the New York Fed, that debt level is now over $18 trillion, with credit card debt hitting $1.21 trillion.

Delinquent debt is still relatively low, so there is a silver lining, but $18 trillion in debt being held by US residents is 3x the total annual tax revenue receipts by the IRS. In other words, it would take the IRS over 3 years to bring in the same amount in tax revenue as current US consumers hold in debt, a massive sum.

In addition, Recruitonomic’s latest jobs report is showing a “white collar jobs recession.” Specifically, their report said, in part, the following: “Summing up employment across three sectors—information and communication, professional and business services, and financial activities—shows a significant disparity. Initially, the data suggested a steady increase in total employment……However, the revised data reveals a different trend, with employment figures declining….the three predominantly white-collar sectors have experienced a downturn in employment levels, while other sectors grew at a healthy pace. The white-collar recession, then, is not just a decrease in job openings across the sectors, but also job losses.”

Even considering all of these data points together, there is still not enough evidence to fully predict a recession is imminent, but once again, 2025 is likely a year of turmoil and you owe it to yourself to review your budget again – both corporate and personal. You should take the time now to see if you can make any adjustments to prepare for a slowdown in economic activity and ride out the ensuing issues that correspond with that.

Warren Buffett’s Berkshire Hathaway corporation is hoarding cash because it can.

Relatedly, while I’m not sure what the point of this musing from the Wall Street Journal was, Warren Buffett is sitting on $300+ billion in cash in Berkshire Hathaway because a) there’s nothing worth buying right now at such elevated valuations, b) he sees trouble ahead and c) he’s been purposefully drawing down his company’s exposure to US equities for likely those exact reasons. There are also those prognosticators who believe all of these actions (or inaction) that Buffett is undertaking is to prepare Berkshire Hathaway to operate without him.

Whatever the reason(s), there’s too much happening economically clouding the horizon out there to justify Buffett – or anyone else who may run his company – spending that amount of cash. Better to sit on it and ride out whatever may come, and swoop in to purchase another attractive asset for their holdings once valuations are more appetizing.

DeepSeek completely exposed the AI hype bubble.

Following yet another revelation about DeepSeek and its evisceration of the capital investment structures behind other AI platforms, another opinion piece dropped which sheds additional light on the impact the Chinese startup is having on the US tech giants.

Much like last Newsletter’s spotlight on DeepSeek, the reality is all the AI hype is finally coming back closer to earth. Microsoft’s own CEO Satya Nadella came out last week and admitted that it has been just that: hype. Nadella zeroed in on comments surrounding the advent of AI is bringing about the second Industrial Revolution. His response to that was pointed: "So, the first thing that we all have to do is, when we say this is like the Industrial Revolution, let's have that Industrial Revolution type of growth. The real benchmark is: the world growing at 10 percent. Suddenly productivity goes up and the economy is growing at a faster rate. When that happens, we'll be fine as an industry.”

Finally, someone prominent said it. This is coming from the CEO of a company that has literally invested billions of dollars in OpenAI. We are just not there yet (10 percent worldwide growth), not even close.

Gen Z wants more out of life than sitting in a cubicle doing a job that just doesn’t matter.

It seems every day there are more articles and research coming out concerning Gen Z and their lack of interest in climbing aboard the monotonous career ladder they’ve seen the generations before them do.

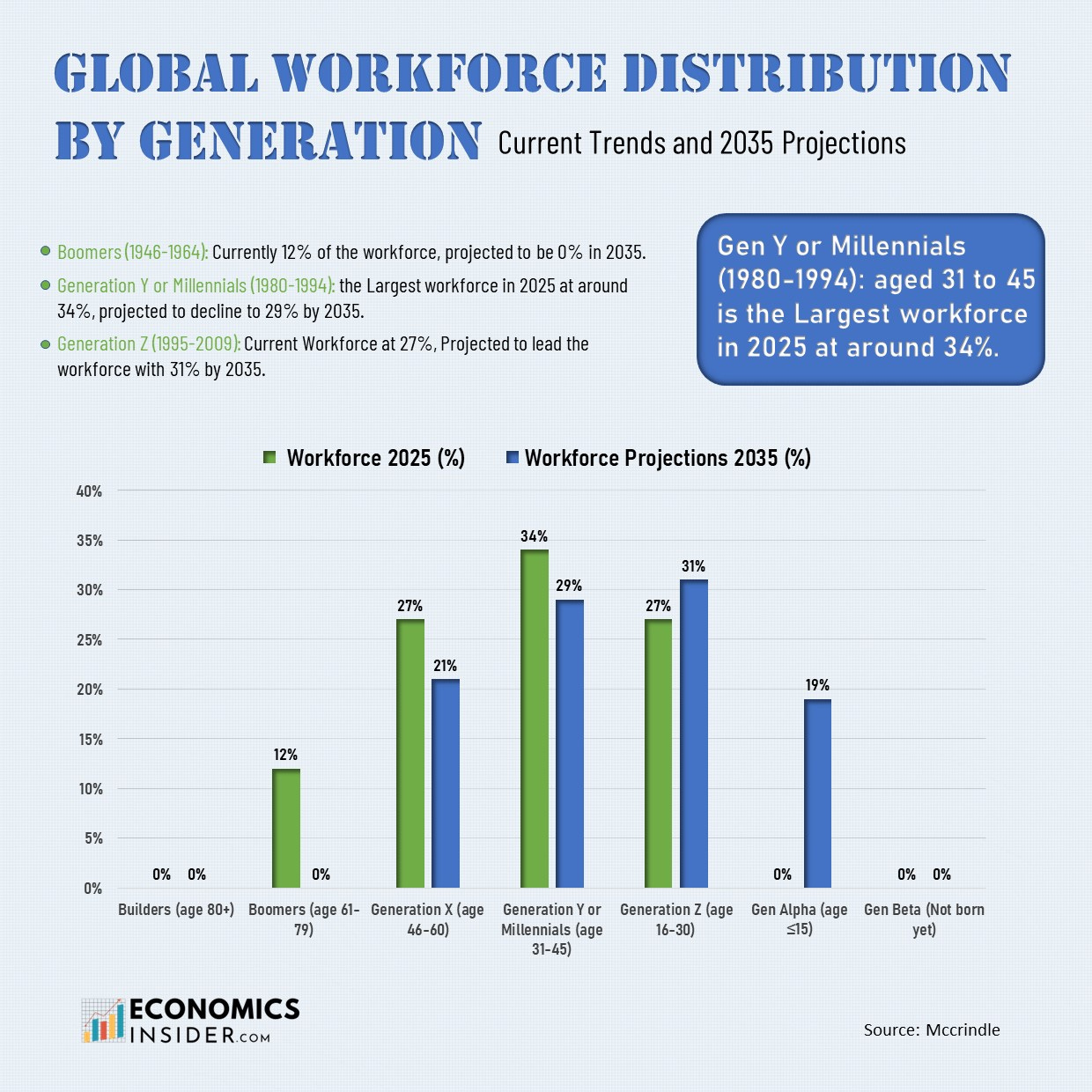

Whether it is for socioeconomic reasons, their complete disdain for leadership styles which frankly generations before them have barely tolerated, rejection of stupid corporate jargon, or simply want something more out of life than just sitting in a cubicle doing a bullshit job, companies are going to have to do more to convince generations coming after them to join their firm. In ten years time, they will rule the roost in the workplace, comprising the largest segment of the job market.

It is entirely possible entire companies will need to undergo a makeover in order to recast themselves as offering a product or service which literally matters to people. The days of a company being able to bring in new employees to entry level roles just for the sake of filling job openings are coming to a close, simply because there are a) going to be less people to fill those roles, and b) these next generations are unlikely to be interested in working for companies who do uninteresting work or require them to stare at cubicle walls for hours on end.

The State of Texas is considering career and vocational training an emergency legislative item this year.

Recently announced by the Governor of Texas as an emergency legislative item was the need to expand career and technical education in the State.

In his State of the State address, the Governor highlighted some of the urgency for this emergency item for the Legislature, including “that by 2030, more than 60% of jobs in the state will require education or training beyond a high school diploma. However, according to him, less than 40% of Texas students attain a degree or workforce training within six years of graduating from high school.”

February (2025) was also Career and Technical Education Month in the State of Texas, highlighting “the value of career and technical education in providing students with practical skills and pathways to rewarding careers,” according to a release from the Governor’s Office.

Apple and Google are just some of the big companies flocking to invest in Texas, so it stands to reason they will need the workforce available to work on all their projects in the State. Calling on the state legislature to do more is a step in the right direction.

-------------------------------------------------------------------------------------------------

© March 2025, Brandon Caldwell. All rights reserved. Hyperlinks are used frequently for proper credit to source material on respective websites, news articles, social media or other sources. Images are used with and in credit to rights reserved to their respective owner(s). While it can be a useful tool, no ChatGPT or other generative AI was used in the production of this newsletter. Opinions are mine and do not reflect the opinion or policy of others including employers past or present.

I’m becoming more and more of the opinion that the winners in AI will be the companies that benefit from productivity gains and cost cuts, and not the companies producing the hardware. There will likely only be one or two companies that are really making money off their investments.