Newsletter #18 (2/17/2025)

Bank of America stock market concerns, corporate efficiency, and beef prices going higher?

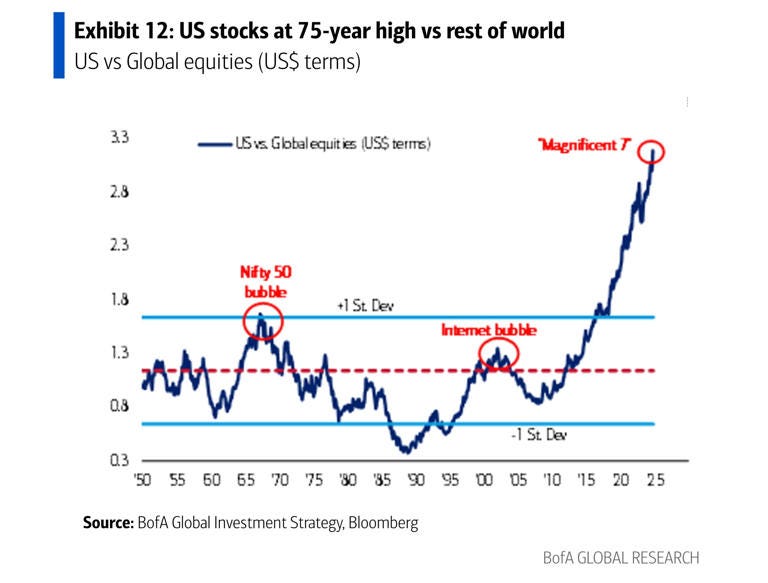

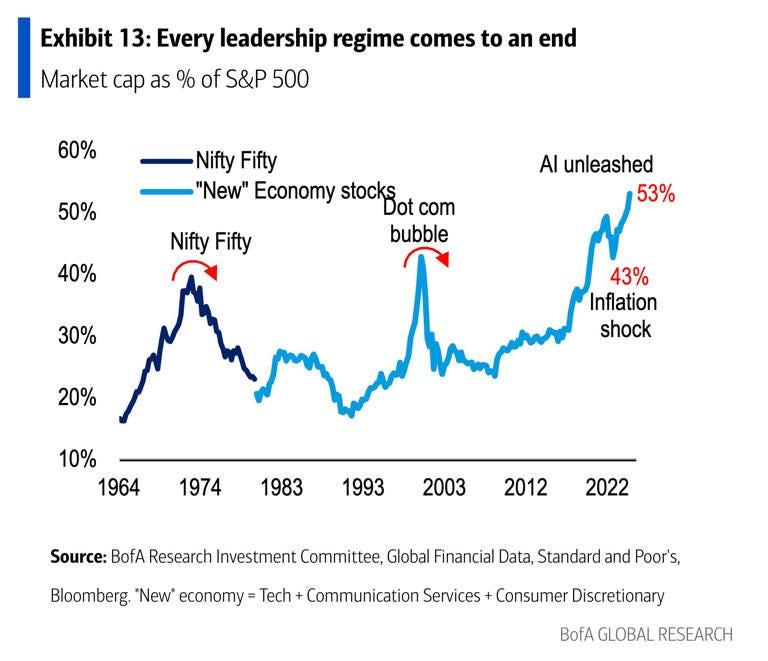

Bank of America analysts are becoming fearful about the U.S. stock market.

BofA’s analysts released their latest assessment a few days ago about the U.S. stock market and their points seem to be well founded. One does not really have to look far into the data to see what everyone can (or should) plainly see: stocks are overpriced, and have been for quite some time.

From a historical perspective, the AI binge – directly following the inflationary surge from the COVID-era of massive government spending – seems to be mimicking the bubble activity from the Dot Com Era.

Consider the following combined passages here from the article: “Within the US, the S&P 500's largest five stocks are now 26.4% of the index. Part of the reason the market has gotten so concentrated is because of passive investing, where investors shovel money into indexes indiscriminately. Passive funds dominate with 54% market share. Momentum reversals are becoming unusually sharp. A 50%+ 'new economy' drawdown (smaller than dot com) could drag the entire index down 40%," wrote Jared Woodard, and investment & ETF strategist at Bank of America.

More corporate restructurings and efficiency cuts.

Stop me where you have heard this before. Dine Brands (IHOP and Applebee’s), International Paper, Blue Origin, Kohl’s, Kroger, Redfin, Chevron and now Southwest Airlines have all announced significant job cuts to their respective corporate staffs in the last several days.

Southwest Airlines, embarking on the first-ever layoffs in the company’s history, is focused on the cuts being part of a plan to “transform the company into a “leaner, faster, and more agile organization,” Southwest CEO Bob Jordan said in a statement.”

Chevron’s Vice Chair Mark Nelson said their cuts are to "simplify (their) organizational structure, [execute] faster and more efficiently, and position the company for stronger long-term competitiveness.”

Simplify. Agile. Efficiency. Corporate buzzwords that mean “we have to make things more efficient to squeeze out profit in a likely more challenging economic environment.” Be ready.

Major U.S. brands are simplifying pricing strategies and adopting new value tactics to raise revenue.

According to a recent WSJ article, major companies are tinkering with how they present their products to consumers at the grocery store in response to challenges in the economy.

PepsiCo is one such company working on this. Specifically, they are “working on a greater range of package sizes to serve shoppers at different times of the month, when they may have more or less cash on hand. For example, PepsiCo will sell multipacks with as few as six or eight bags of chips, an option that could appeal to a cash-strapped shopper at the end of the month, CEO Ramon Laguarta said. The company’s multipacks typically contain 18 or more bags of chips. PepsiCo is also introducing a single-serve bag of chips for under $1.”

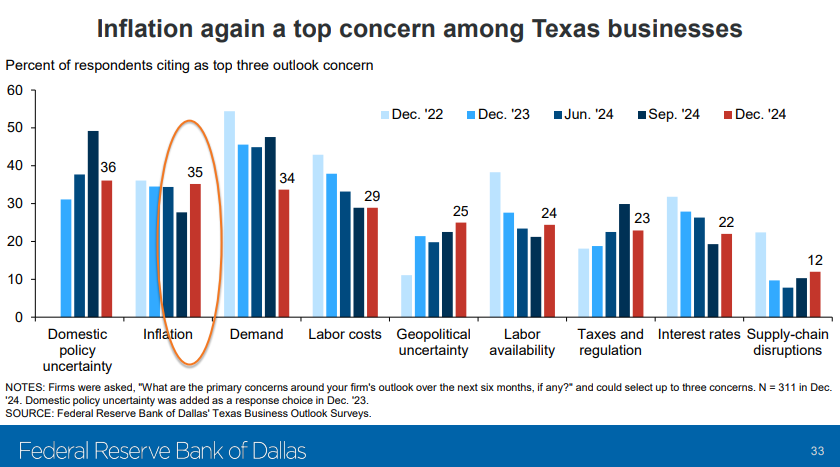

The State of Texas issued a tepid economic growth forecast for 2025.

The Dallas Fed presented their research showing how they believe 2025 will shape up for growth in the State of Texas, and while still very positive, the data does show anticipation for a gradual cooling in the economy due to some particular headwinds.

Uncertainty on domestic policy, inflation, and demand are the top 3 concerns for Texas businesses, according to the business outlook surveys the Dallas Fed conducts every month.

Despite these concerns, again, there is a remarkable positivity to business leaders in Texas for how they view 2025 playing out. I am hopeful the optimism continues.

Texas continues to lead the nation in cattle production, but there’s a catch.

You may be wondering, “why the hell does that matter to me at all?” While Texas is usually the leader in beef production in the United States, the overall national cattle inventory is near a record low, per Texas Farm Bureau.

This means that, despite inflationary pressures easing in other areas of the economy, cattle prices will remain elevated throughout 2025 and into 2026. If you buy beef – really any beef products – at the grocery store, be prepared to pay continued high prices, even escalating prices, for at least the next year.

-------------------------------------------------------------------------------------------------

© February 2025, Brandon Caldwell. All rights reserved. Hyperlinks are used frequently for proper credit to source material on respective websites, news articles, social media or other sources. Images are used with and in credit to rights reserved to their respective owner(s). While it can be a useful tool, no ChatGPT or other generative AI was used in the production of this newsletter. Opinions are mine and do not reflect the opinion or policy of others including employers past or present.

I’m honestly wondering if 401k boards won’t be facing liability down the road for not offering an equal weight option for the S&P 500. I don’t think the average participant understands the concentration risk…