Newsletter #16 (1/27/2025)

The US housing market, jobs in the State of Texas, more corporations looking for workforce efficiency....

Is America’s economy strong enough to pull the housing market out of the dumps?

Unlikely, at least in the short term. The 2024 annual report from the National Association of Realtors (NAR) showed existing home sales hit their lowest annual amount since 1995.

Mortgage rates, home prices, commodity and grocery prices are just some of the economic data holding the housing market back and keeping would-be homebuyers on the sidelines. Mortgage rates in particular remain stubbornly high, especially compared to data from the last several years.

Not all is doom and gloom with this latest NAR data, though. December 2024 existing home sales increased over 9% when compared to December 2023, so perhaps some homebuyers are getting comfortable with the fact that mortgage rates will remain at an elevated level for the time being. When combined with new home sales data, December 2024 has indeed shown some promise over 2023. Time will tell, as we likely can expect interest rates to not be slashed enough to make a dent in today’s mortgage rates.

The State of Texas continues down the warpath of job creation.

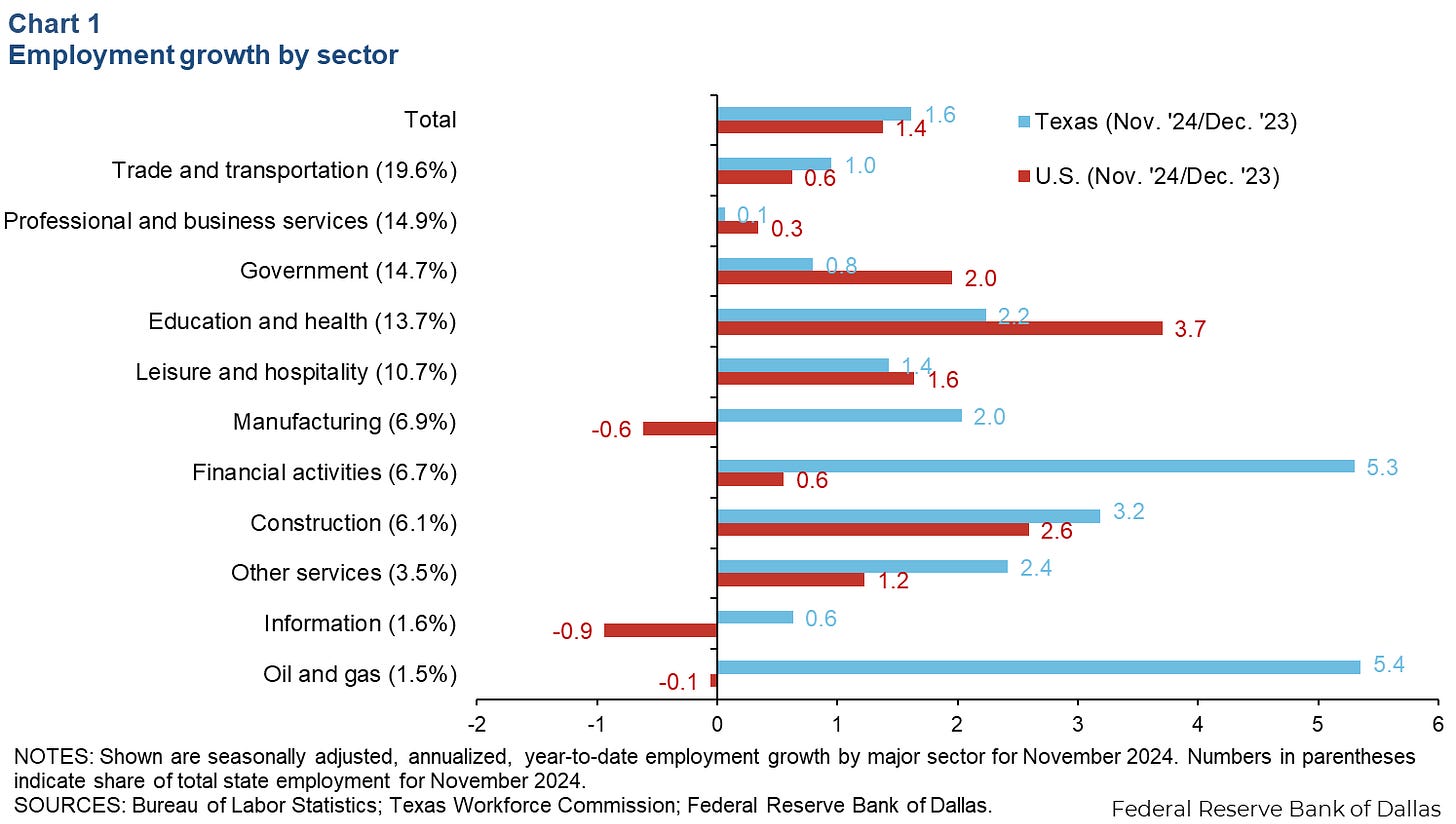

The Texas Workforce Commission released its final 2024 report, showing that Texas “achieved a new record-high level for jobs and the civilian labor force in December. The state added 37,500 positions over the month, reaching a total of 14,318,700 nonfarm jobs. Texas added 284,200 jobs from December 2023 to December 2024, bringing the annual nonfarm growth rate to 2.0 percent, which outpaced the U.S. growth rate by 0.6 percentage points.”

The Governor released a statement to chime in on the latest TWC announcement, adding, “As we break record after record for total jobs, the number of Texans working, and our labor force, we begin the new year as America’s job creator. Jobs are growing here, businesses are growing here, the future is growing here.”

Coupled with a unemployment rate staying very steady at 4.2%, the labor market in Texas appears to be very strong entering 2025.

On the opposite end, Meta, Amazon, and Starbucks are the latest corporations cutting jobs for efficiency.

Meta, Legoland Florida, Bridgestone, and multiple others like CNN, Amazon and Starbucks, collectively announced approximately 6,000 jobs would be shed in the coming days, with all citing some version of corporate efficiency as the reason.

The layoffs, while not substantial when viewed in the context of the total US workforce (see chart below), do reflect a growing trend I’ve previously noted several times in past newsletters. Companies are increasingly looking for efficiency in their workforce, adjusting to higher interest rates and demanding higher production from those who remain employed.

Once again, if you are not doing the same, you should start today. Your competitors are.

Perdue Farms shuttering a chicken farm in Tennessee is more than just another layoff for efficiency reasons.

The decision, impacting roughly 400 jobs, is tough news for the town of approximately 3,000 people in between Nashville and Knoxville.

The truth is this announcement continues a trend that has been gradually impacting the nation’s agricultural communities since 2023. As the article indicates, other chicken farms operated by companies like Tyson Foods have been scaling back their operations following the expansion era that peaked during COVID.

And the reality is settling in that this is an issue that is not contained to just chicken farming. Many agricultural experts believe the greater agricultural industry in the United States is in a recession. Following a significant drop and even substantial losses in farming in 2024, “2025 isn’t forecast to be much better, with margins expected to be in the red again for all major row crops. The high input and high interest rate environment, coupled with low commodity prices, is a recipe that could also mean more consolidation in agriculture in 2025.”

Consolidation, referred to in other terms as mergers, will likely mean higher prices for consumers in 2025 and beyond, as producers raise prices to overcome the cost challenges they are facing to feed the nation. As more of the large corporate producers shutter production facilities to save costs, and explore mergers with other producers to free themselves of costly debt, it does not appear there will be any significant relief at the grocery store.

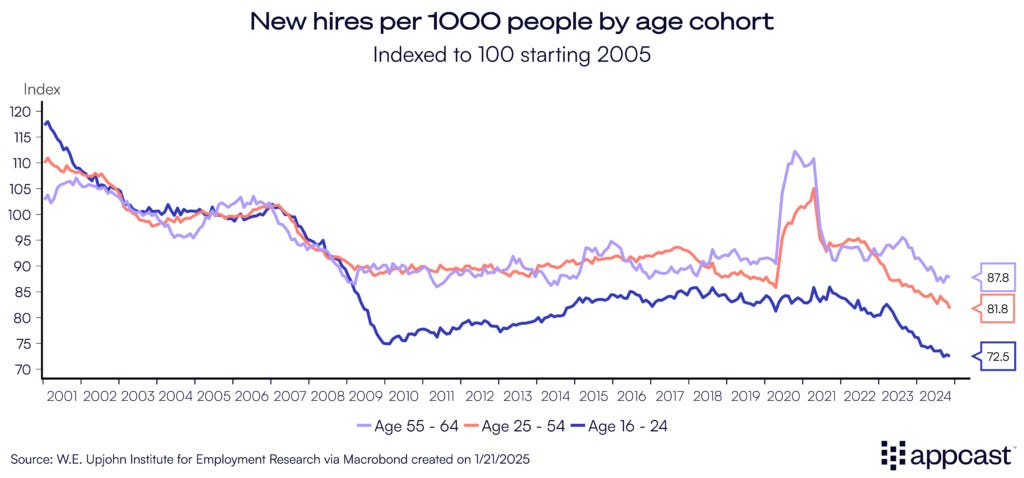

Gen Z is having a rough go of it as they are leaving college.

The latest report from Recruitonomics shows that Gen Z candidates are experiencing some trouble landing that first job as they are getting out of college.

In particular, Sam Kuhn’s research found companies that are “faced with tighter budgets…..are prioritizing workers with proven track records—those who can contribute immediately—over younger candidates still building their experience.”

You don’t have to look far to find additional data to support this point. Upwork, the large freelance hiring platform, released its 2025 Skills report, which indicated “businesses are prioritizing deep, technical expertise over generalist roles.” Further, “74% of executives say degrees are irrelevant when hiring freelancers, focusing instead on proven expertise. In fact, 78% of CEOs assert that their top freelancers contribute more value than degree-holding employees. As the reliance on degrees diminishes, businesses are prioritizing demonstrated capabilities to stay competitive.”

So, Gen Z candidates are likely faced with a scenario many faced during the Great Recession: take on a role that is outside of their degree field, look for internship(s) or externship(s) that will give them additional skills they can list on their resume or parlay into another role, and/or go back to school to gain additional skills that can help them compete on the job market. It is likely none of these options are appealing to many, as the cost of going to university becomes more prohibitively expensive.

-------------------------------------------------------------------------------------------------

© January 2025, Brandon Caldwell. All rights reserved. Hyperlinks are used frequently for proper credit to source material on respective websites, news articles, social media or other sources. Images are used with and in credit to rights reserved to their respective owner(s). While it can be a useful tool, no ChatGPT or other generative AI was used in the production of this newsletter. Opinions are mine and do not reflect the opinion or policy of others including employers past or present.